The costs associated with citing and building wood bioenergy projects can exceed those to build and operate natural gas or coal plants (in terms of dollars per unit of electricity output). As such, factors determining the success and failure of projects matter. Analysis by Forisk Consulting of over 500 operating and announced wood-using bioenergy projects detail key trends since 2010 (Figure). [Note: detailed projects list and analysis are available to Wood Bioenergy US subscribers.]

Over the past year, key decreases have occurred with electricity projects, most increases in projects and volumes have been associated with wood pellet projects in the US South, while other sub-sectors – including CHP, thermal and liquid biofuel (i.e. cellulosic ethanol) – have remained relatively static. While total projects that pass viability screens increased in the past year and a half, the fastest growing category is “shut down/canceled.” More projects have been canceled or shut down than have advanced to pass viability screens. Half of the projects that are on hold, shut down, or canceled are electricity projects.

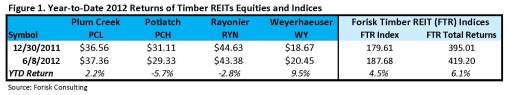

For investors and analysts tracking bioenergy, wood and timber REIT markets, Forisk offers “Timber Market Analysis” on August 15th in Atlanta, a one-day course for anyone who wants a step-by-step process to understand, track, and analyze the price, demand, supply, and competitive dynamics of timber markets and wood baskets. For more information, click here.