Rayonier’s (RYN) announced ten percent dividend increase reminded me of the well-traveled quote from investor and Dallas Mavericks owner Mark Cuban on stocks and dividends:

I believe non dividend stocks aren’t much more than baseball cards. They are worth what you can convince someone to pay for it.

The quote speaks to the importance of considering ‘total return’, which accounts for both (cash) income and (capital) appreciation, when valuing investments. For timberland-owning REITs, this includes (1) quarterly dividends and (2) changes in stock prices for a given time frame. For direct timberland investments, this includes (1) income generated from, in part, timber sales and other forest management activities as well as (2) appreciation of the land and standing forest.

Last week, NCREIF announced year-to-date (through Q2 2012) total returns for private US timberlands of 0.97%. This total return number includes 1.54% from income and -0.57% from appreciation. Alternately, publicly-traded timber REITs, as measured by the Forisk Timber REIT (FTR) Index, generated year-to-date total returns (through July 27, 2012) of 19.93%. As of July 27, 2012, the four timber REITs provided the following dividend yields:

- Plum Creek (PCL): 4.15%

- Potlatch (PCH): 3.69%

- Rayonier (RYN): 3.50%

- Weyerhaeuser (WY): 2.54%

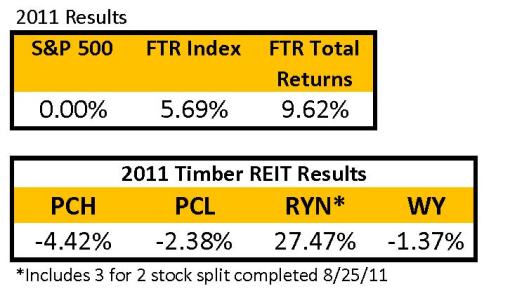

However, timberlands-versus-timber REITs is not an acorn-to-acorn comparison. For multi-year investors, direct ownership of timberlands continue to provide superior capital preservation and diversification, while public REITs offer superior liquidity and total returns with more risk. While timber REITs attract attention from dividend-seeking investors, the figure below highlights the advantages and disadvantages of focusing solely on dividend yields (income) when investing in equities. Equity values can and will dive with the overall market (see 2008-2009) while long-term investors gained through buy-and-hold-and-dividend reinvestment strategies.

Reminder: Early registration for “Timber Market Analysis” ends August 1st. This one day course will be taught August 15th in Atlanta. Click here for more information